Checking Accounts

PyraMax Bank offers personal checking accounts centered on your convenience. With a variety of checking options available, pick a plan that is unique to your lifestyle and checking activity.

Comparing Checking Accounts

Fees and Charges

Click the link below to view the potential fees and charges that may be assessed against your account.

Fee Schedule

Comparison table 2 of personal checking accounts

| |

MaxRewards Checking Account |

MaxInterest Checking Account |

Representative Checking Account |

| Qualifications |

For conscientious savers who want to earn a tiered interest rate |

For strategic savers who want to earn the highest interest rate offered for a PyraMax checking account |

For court-appointed personal representatives for an estate or representative payees named by the Social Security Administration |

| Minimum Opening Deposit |

$25 |

$25 |

$0 |

| How to Avoid a Monthly Maintenance Service Charge |

Maintain $10,000 or greater in combined PyraMax Bank personal deposit and/or loan balances |

Monthly direct deposit of $250 or more |

$0 |

| Monthly Maintenance Service Charge |

*$5 |

*$15 |

$0 |

| Interest Bearing |

|

|

|

| Online Banking & Online Bill Pay |

|

|

|

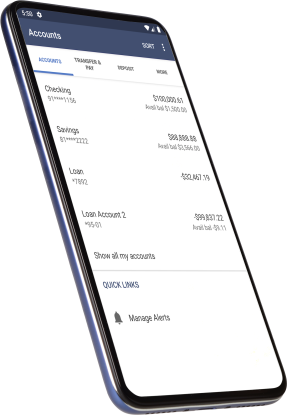

| Mobile Banking & Mobile Bill Pay |

|

|

|

| Estatements |

|

|

|

| uChoose Rewards |

|

|

|

| ATM/Debit Card |

|

|

|

| Learn More |

MaxRewards Checking Account |

MaxInterest Checking Account |

Representative Checking Account |

uChoose Rewards

uChoose Rewards is a rewards program where you earn points just for using your PyraMax Bank debit card. You can redeem the points for anything you choose from a huge online rewards catalog, including event tickets, airline tickets, gift cards, electronics and even cash!

uChoose Rewards

Checking Accounts FAQ

A third-party check is a one made payable to an individual who then signed it over to another individual. Many banks do not accept third-party checks, including PyraMax Bank. A third-party check may not be payable at the bank that it was drawn off of, therefore causing unnecessary returned item fees for our clients.

PyraMax Bank is same day availability. Check holds may be placed on a case-by-case basis.

You can place a stop payment on your personal account online by logging into online banking. Choose “account services” under the Customer Service tab. You can also contact your local bank branch for assistance. Placing a stop payment is simple, but a fee may apply.

Accounts that fall to a zero balance may close automatically. Please leave at least $0.01 in your account to keep it open. If your account does close automatically and you need assistance to reopen it, please contact your local bank branch.

Yes, there is a cost to purchase both a bank check and a money order. Please see your account disclosures for information or contact your local branch.

An individual must be 18 years old to open a checking account as a sole owner of the account. Exceptions may be made for individuals ages 13-17, provided that the account is held jointly with an adult over the age of 18. Debit Cards may be issued to individuals starting at the age of 13. However, if the individual is between the ages 13-17, a Minor Indemnification form must be completed and signed by the parent or guardian.